ESG – EU sets new compliance rules for a sustainable economy

Climate change and environment have become mega trends of this century. In view of the risks of climate change, the EU is currently establishing a completely new legal framework for a sustainable economy as part of the Green Deal and the EU Action Plan on Sustainable Finance. The focus lies on Environmental Social Governance (ESG) as a broad term for Corporate Social Responsibility (CSR). This affects not only finance, but also the real economy at corporate as well as product level. Sustainability is therefore no (longer) mere marketing, but also requires determined Compliance with a complex legal framework at corporate level. This article gives an overview of the new regulations on ESG reporting:

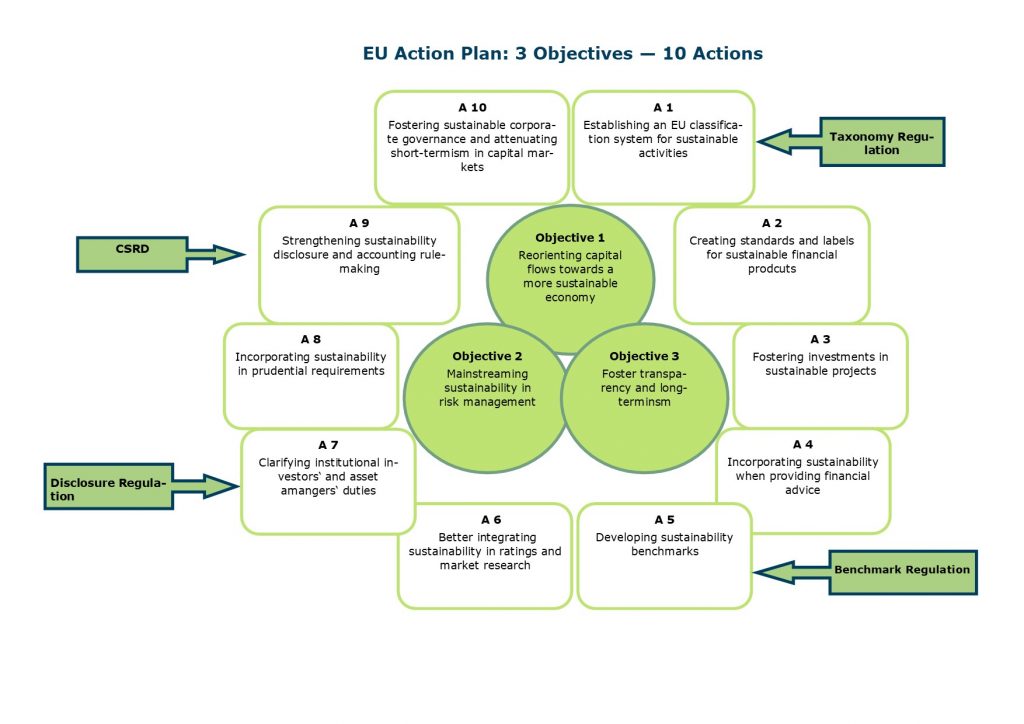

The EU Action Plan on “financing sustainable growth” (Sustainable Finance) pursues 3 objectives with 10 actions. In essence, the aim is to define which economic activities are sustainable, and to lead capital toward sustainable investments. A new legal framework is intended to create a consistent and coherent flow of sustainability information along the financial value chain and to prevent greenwashing. The following legal acts are of particular relevance in this matter:

- the proposal for a Corporate Sustainability Reporting Directive (CSRD) of April 21, 2021,

- the Regulation (EU) 2019/2088 of November 27, 2019 on sustainability-related disclosures in the financial services sector (Disclosure Regulation)

- the Regulation (EU) 2020/852 of June 18, 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (Taxonomy Regulation)

- the Regulation (EU) 2016/1011 of June 8, 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds as amended by Amendment Regulation (EU) 2019/2089 of November 27, 2019 (Benchmark Regulation).

Sustainability Reporting-CSRD

On April 21, 2021, the EU Commission presented the already expected proposal to amend Directive 2013/34/EU on the disclosure of non-financial information (CSR Directive). According to the proposal, the CSR Directive shall be complemented by a directive on sustainability reporting (“proposal for a Corporate Sustainability Reporting Directive – CSRD).

Under the CSR Directive, only around 11,000 large listed companies, banks, and insurance companies with more than 500 employees had to provide information on environmental, social and employee issues, respect for human rights and combating corruption and bribery in their non-financial statements each year since 2018. With the planned expansion of the scope to include all large companies and all companies listed on regulated markets (except for listed micro-entities), the Commission estimates that in the future around 50,000 companies will be subject to reporting obligations.

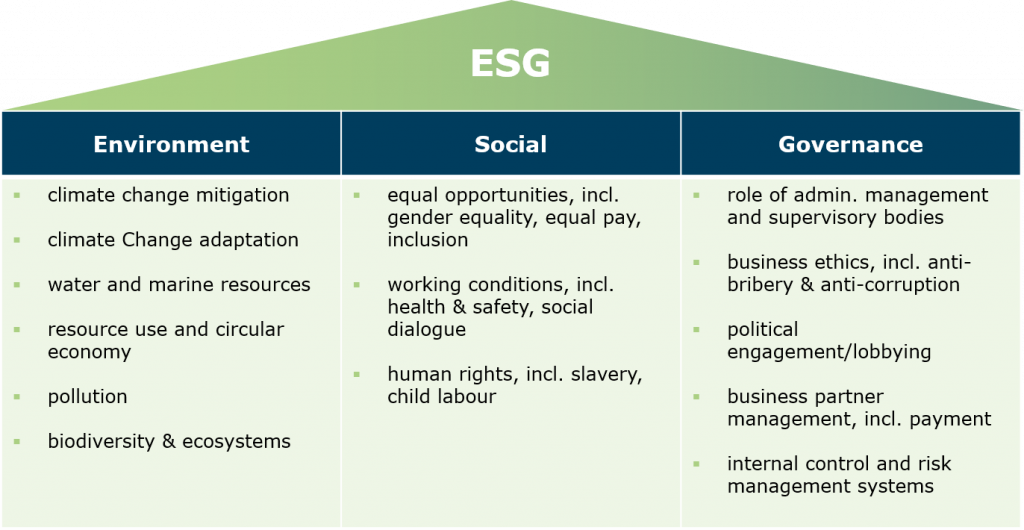

The EU sustainability reporting follows the classic ESG categories and includes the following aspects:

The CSRD’s recommendation is built on the requirements for sustainability reporting stipulated in the CSR Directive and revises them to better reconcile the requirements for sustainability reporting with the broader legal framework for sustainable finance, including the Disclosure Regulation and the Taxonomy Regulation. This shall be achieved primarily through standards for sustainability reporting, considering indicators, screening criteria and “Do No Significant Harm” thresholds of the taxonomy.

These standards shall be adopted by the Commission as a delegated act. The first draft is to be initially prepared by the European Financial Reporting Advisory Group (ERFRAG) with input from stakeholders presumably by mid-2022. It is supposed to build on the standardization initiatives at global level, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the International Integrated Reporting Council (IIRC) as well as the Climate Disclosure Standards Board (CDSB) and the CDP (Carbon Disclosure Project).

Furthermore, a general EU-wide audit obligation (Assurance) for sustainability information is supposed to be introduced for the first time. This is intended to ensure the reliability of sustainability reporting. In the course of this, member states can also allow companies other than auditors to audit sustainability information.

Disclosure Regulation

The Disclosure Regulation regulates how financial market participants (including asset managers and financial advisors) should disclose sustainability information, i.e., climate or environmental risks in their investment decisions, towards end investors and asset owners. To meet the requirements of the Disclosure Regulation – and thereby ultimately the needs of end investors including private individuals and households – financial market participants need adequate information from the invested companies. The Disclosure Regulation distinguishes between company-related and product-related transparency obligations.

At corporate level obliged parties – regardless of the design of the financial product or the target market – shall publish on their website information on

- their policies on the integration of sustainability risks (Article 3),

- considering principal adverse impacts of investment decisions on sustainability factors (PAIs) (Article 4),

- how their remuneration policies are consistent with the integration of sustainability risks (Article 5).

Financial market participants may declare that they do not deem sustainability risks to be relevant (Opt-out), but in this case they must provide a clear explanation of the reason therefor (comply or explain). However, this Opt-out possibility for financial market participants with more than 500 employees only exists until June 29, 2021!

A classification takes place at the product level. The product providers classify their products themselves and must identify them accordingly:

- Non-sustainable or other products that do not put emphasis on ESG aspects (Article 6): Obliged parties must include descriptions on the consideration of sustainability risks at product level in pre-contractual disclosures. If sustainability risks are deemed to not be relevant, this must be explained clearly and concisely. According to Article 7 of the Taxonomy Regulation, the pre-contractual disclosures must be accompanied by the explicit statement that the EU criteria for environmentally sustainable economic activities is not being taken into account.

- ESG strategy products “light green products” (Article 8): These are financial products that advertise, among other things, ecological or social characteristics, provided that they are companies with good corporate governance.

- ESG impact products “dark green products” (Article 9): This category is reserved for products that have explicit sustainability objective.

Since March 10, 2021, Level I of the Disclosure Regulation applies, according to which written policies on the integration of sustainability risks must be published continuously up-to-date, and the transparency of such integration must be ensured. Regarding the content, method, and presentation of the information the Disclosure Regulation is complemented by regulatory technical standards (RTS) of the European Supervisory Authorities (ESAs) (Level II). The ESAs published a final draft of the RTS on February 4, 2021 and submitted it to the Commission. The application of the RTS is planned from January 1, 2022.

Taxonomy Regulation

The Taxonomy Regulation introduces a classification system for environmentally sustainable economic activities to promote sustainable investments and to combat greenwashing of “sustainable” financial products. It requires companies, that fall within the scope of the CSR Directive, to disclose certain indicators on the extent to which their activities are environmentally sustainable according to the taxonomy. Sustainability is supposed to become measurable and – as a logical consequence – comparable. To this purpose, non-financial companies must inform about the proportion of the turnover and capital expenditure that can be classified as sustainable within the meaning of the Regulation (Article 8). The Commission presented a draft delegated regulation on May 7, 2021 which further defines the key performance indicators (KPIs) that are to be reported. Comments on this draft can still be submitted to the EU Commission until June 2 as part of the public consultation (see link at the end of this article).

According to Article 3 of the Taxonomy Regulation, an economic activity shall qualify as “environmentally sustainable” where it (cumulatively)

- contributes substantially to one or more of the six environmental objectives set out in the Taxonomy Regulation (climate change mitigation, climate change adaption, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, protection and restoration of biodiversity and ecosystems);

- does not significantly harm any of the other environmental objectives (“Do No Significant Harm” criteria, “DNSH”);

- is carried out in compliance with the minimum safeguards (“Minimum Social Safeguard” criteria, e.g. OECD guidelines) and

- complies with technical screening criteria that have been established by the Commission.

On April 21, 2021, the European Commission presented a first delegated act with comprehensive technical assessment criteria of the environmental objectives climate change mitigation and climate change adaption mentioned in the Taxonomy Regulation. For these objectives, the Taxonomy Regulation will already apply from January 1, 2022. Further delegated acts on the remaining environmental objectives shall follow by December 31, 2021, and the Taxonomy Regulation shall apply from January 1, 2023.

Benchmark Regulation

As part of the EU Action Plan for a sustainable financial system, two new categories of benchmarks were added to the Benchmark Regulation:

- EU Climate Transition Benchmark

- EU Paris-aligned Benchmark

The inclusion of the climate benchmarks is intended to create more transparency in the use of CO2-related indices and to prevent greenwashing to the greatest possible extent. Since April 30, 2020, administrators, i.e., natural or legal persons that has control over the provision of a benchmark, must declare their commitment to the consideration of ESG factors when determining the benchmarks and the benchmark methodology. On December 3, 2020, the EU Commission published delegated acts to further specify the requirements. It is supposed to review the minimum standards for climate benchmarks by December 31, 2022 and beyond that present a report on the feasibility of a broad ESG benchmark.

The Benchmark Regulation also creates incentives for companies to improve their ESG performance, especially as the demand for sustainable indices is increasing among investors. Furthermore, the German Stock Exchange responded to this and in March 2020 introduced a new sustainability index, the “Dax 50 ESG”, which is intended to provide an important basis for the transformation process of the real economy and its financing. It remains to be seen whether the Dax 50 ESG will be able to meet the requirements of a future ESG benchmark.

Outlook

With the intended adjustment of the scope of the CSR Directive by the CSRD, the group of companies that are subject to reporting obligations under the Taxonomy Regulation will be significantly expanded. In Germany alone, this would affect an estimated 18,000 companies. With the German Sustainable Finance Strategy published on May 5, 2021, the German government finally set course for the further development of the EU taxonomy, particularly regarding a social taxonomy. The strategy intends the European as well as the national Sustainable Finance agenda to form a powerful lever to support and strengthen regulatory ESG frameworks.

The pressure on the real economy continues to grow with the ongoing development of the regulatory canon on ESG reporting. Especially the real estate industry must plan ahead to get their cost and process controlling fit for the future. One of the keys to this sustainable transformation towards a meaningful ESG reporting will be automating data acquisition and data management. For this purpose, comprehensive building- and location-specific information, for example on the CO2 emissions of individual properties and portfolios or on the infrastructure, is needed.

Not only the construction and real estate industries, but also other sectors of the real economy are in a tight spot. Existing regulations and legislation initiatives to improve environmental protection and social aspects (greenhouse gas emissions, respect for human rights within supply chains) are complemented by the approach of a Sustainable Finance, among others, in the shipping, automotive, or textile industry. The demand for ESG financial products among investors is continuously increasing. So-called impact investments are already being advertised by many investment companies, e.g. in the fields of healthcare, water supply, renewable energies or agricultural education.

Related links

Text of the EU Taxonomy Climate Delegated Act (Provisional version. The final text will be available soon)

Annex 1 to the EU Taxonomy Climate Delegated Act (Provisional version. The final text will be available soon)

Annex 2 to the EU Taxonomy Climate Delegated Act (Provisional version. The final text will be available soon)