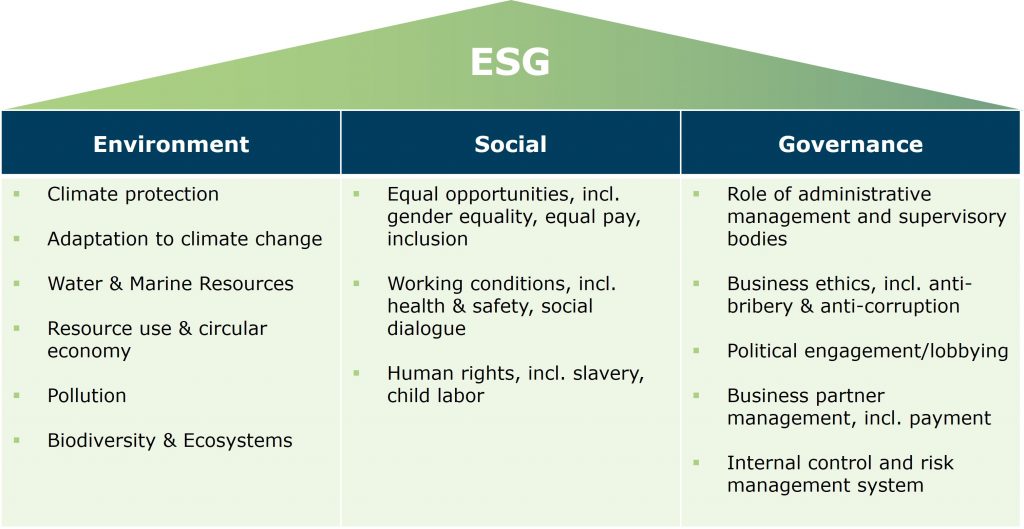

Sustainability and ESG (Environmental, Social, Governance)

ESG has become a central core task for corporate organization and risk management. Companies in all industries must demonstrate to their many stakeholders that their business is being conducted in an ethically responsible and sustainable manner worldwide – a task that, due to its cross-cutting nature and complexity, must necessarily be approached in a holistic manner. With our recognized expertise and experience in environmental compliance and corporate governance, particularly in the area of establishing and expanding holistic compliance management and control systems, we have been combining these aspects in our consulting practice since our founding more than 10 years ago.

ESG compliance expectations and the resulting increased awareness of these issues at the corporate level have led to a massive revaluation of sustainability issues. ESG, which was initially primarily an investor-driven topic, has long since become a global sustainability trend that is affecting all industries.

For example, the most recent amendment to the German Corporate Governance Code explicitly enshrined sustainability as a key criterion of good corporate governance. Legislators and regulators in the EU and the USA are increasingly requiring companies to disclose and insure information on the extent to which their business activities are environmentally sustainable and in accordance with ethical values and guidelines.

Safely navigating the ever-evolving ESG regulatory framework is a daunting undertaking, especially if you want to seize the opportunity to proactively secure competitive advantage and stakeholder trust as a visionary leader. For companies, their executives and boards, new challenges arise in addition to increased liability and reputational risks, also in view of the increasingly frequent accusations of “greenwashing”. The task is to set up and equip the corporate organization around governance, risk and compliance in such a way that it can monitor, credibly assess and demonstrate the ESG performance of the company and, where necessary, further improve it.

Overview

- ESG takes a comprehensive and holistic approach by requiring the identification and disclosure of ESG risks and their integration into existing compliance risk management in order to manage, monitor and mitigate them over a sufficiently long period of time and to review the measures regularly.

- ESG is thus, at its core, a compliance task.

- We screen companies along ESG criteria with a view to ESG risks in connection with transactions for participating buyers, sellers or financing banks or other third parties.

- We help you to maintain an overview in the face of increasing reporting obligations arising from a wide variety of laws and regulations, and to design your company-wide non-financial reporting in a target-group-oriented and efficient manner.

- To avoid the suspicion of greenwashing and marketing-driven whitewashing from the outset, we also advise you on the appropriate documentation of the individual topic complexes underlying the reporting in a comprehensive internal repository.

- With our recognized expertise and experience in the field of environmental compliance, in particular climate change law, we advise them on all environment-related issues. The “Environmental” pillar of ESG focuses particularly on climate change. This involves both adaptation to climate change and mitigation of its consequences, i.e. climate compliance. Climate-related risks include, in particular, physical risks with regard to individual extreme weather events (e.g. heat and dry periods, floods, storms) or with regard to long-term changes in climatic and ecological conditions (precipitation frequency, amounts, sea level rise and average temperatures), as well as transformation risk in connection with the shift to a low-carbon economy (e.g. coal phase-out, CO2 tax).

- In addition, the classic environmental compliance issues, such as air and water pollution, resource depletion, and biodiversity loss and associated risks, need to be addressed. The list of topics in the “Environmental” pillar is not exhaustive and may have different focuses depending on the industry.

- We provide comprehensive advice to corporate bodies and executives on sustainability-related due diligence and support them with our many years of experience in the strategic realignment of corporate governance structures towards sustainable corporate management.

- With increasing compliance regulations and legislative initiatives to enshrine sustainability-related due diligence and transparency obligations in law, as well as rising expectations of sustainable and responsible corporate governance from diverse stakeholders and a critical public, companies are under increasing pressure to align their corporate processes with ESG issues relevant to them in a wide variety of directions.

- The continuous development of national sustainability regulations in numerous jurisdictions by a wide variety of (law enforcement) authorities and organizations, as well as European legislative efforts (EU Taxonomy, EU Disclosure Regulation, CSRD), call for overarching and flexible solutions and provide an opportunity for boards and executives to closely examine their company’s current organizational and operational structure and to redesign reporting channels and structures.

- We assist companies in preventing greenwashing allegations and lawsuits. With new obligations to disclose ESG factors, a tension arises between the drive for legally compliant sustainability reporting and the performance pressure of companies to meet the increased ESG expectations of investors, customers and regulators for sustainable corporate governance. At the same time, companies must ensure the accuracy and completeness of the information they publish to avoid exposure to accusations and increasing liability risks of “greenwashing.” The issuance of climate and/or greenhouse gas-related or other sustainability-related disclosures and statements must be embedded in the company’s holistic compliance and risk management structure.

- In this respect, companies must ask themselves how they are positioned with regard to ESG issues and what transformation process they want to and must initiate and communicate to the outside world. In the event of half-hearted sustainability strategies or inadequate reporting, there is not only the threat of serious reputational damage. In addition to costly environmental and climate protection lawsuits, (globally) far-reaching (financial) criminal investigations can also be the consequence.